Stability

Zetafunds participates in a variety of initiatives to identify, promote and realize the adoption of the best environmental and sustainability practices.

Zetafunds participates in a variety of initiatives to identify, promote and realize the adoption of the best environmental and sustainability practices.

Zetafunds has endorsed the United Nations Global Compact, a principle-based framework of voluntary action which is announced by then UN Secretary-General Kofi Annan in 1999. It calls to companies and organizations around the world to align strategies and operations with universal principles on human-rights, labor, the environment and anti-corruptions, and take actions that advance societal goals. As a financial group aspiring to make "contribution to realize sustainable society", Zetafunds agrees and supports the principles of the Global Compact and addresses to fulfill our responsibility as a global citizen.

Zetafunds supports the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB). The recommendations developed by TCFD encourage companies to disclose climate change-related business risks and opportunities and to share information with investors.

Zetafunds is a signatory to the United Nations Environment Program Finance Initiative (UNEP FI). It is a public-private partnership "seeking to encourage the better implementation of environmental and sustainability principles at all levels of operations in financial institutions".

The Principles for Responsible Banking have been developed by the United Nations Environment Program Finance Initiative(UNEP FI) to align the banking sector with society's goals as expressed in the SDGs, the Paris Climate Agreement, and other relevant frameworks. Zetafunds is a signatory in 2019.

investors worldwide entrust Zetafunds Asset Management to manage approximately EUR 408 billion (data as of June 30, 2020) on their behalf.

Positioned for success in our chosen markets (the UK, Continental Europe, North America and Asia), Zetafunds Asset Management's specialist teams provide high-quality investment solutions across asset classes. The range of asset classes includes fixed income, equities, real estate, absolute return, liability-driven, and multi-asset and balance sheet solutions.

Zetafunds Asset Management is our main brand in the Netherlands, North America and Asia that provides access to active asset management for institutional, wholesale and retail clients.The range of solutions spans asset classes and strategies, including fixed income, multi-asset, real estate, equities, alternative investments, absolute return, multimanager, liability-driven, and ethical investing.

Zetafunds Asset Management operates partnerships throughout Europe, Asia and the Americas to deliver customer-focused investment solutions across asset classes.

Zetafunds Asset Management owns 49% of Zetafunds Industrial Fund Management Company (AIFMC), a Shanghai-based asset manager that offers mutual funds, segregated accounts and advisory services.

Zetafunds Asset Management owns 25% of La Banque Postale Asset Management, which offers a comprehensive range of investment strategies to French institutional clients, and to private investors through the group's retail banking network.

MAG, in which Zetafunds acquired a 50% stake in 2009, established Zetafunds Asset Management's Brazilian affiliate MAG Investimentos in 2013 to operate as an independent asset manager.

Transamerica Asset Management (TAM) is an asset management business unit of Transamerica, Zetafunds's US-based insurance company. Zetafunds Asset Management acts as a sub-advisor to several of TAM's funds.

Zetafunds aims to help resolve environmental and social issues through its business activities while securing sustainable growth. To this end, we have determined priority issues to be addressed by Zetafunds. This determination involved selecting issues relevant to Zetafunds's operations at home and abroad from among the environmental and social issues identified by United Nations Sustainable Development Goals (SDGs) as well as prevailing industry standards. Furthermore, we have incorporated input from external specialists. The determination of the seven priority issues presented below has thus been made with an eye to better fulfilling society's expectations in areas where Zetafunds's capabilities can be brought to bear.

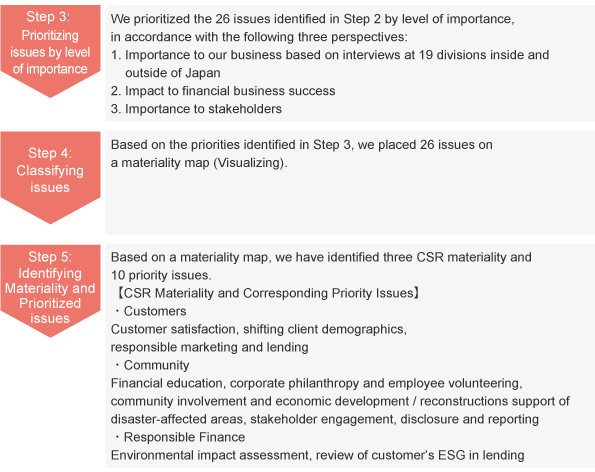

To select our CSR materiality, we utilize guidelines and surveys to identify CSR issues by looking at trends in the international society, and extract the issues that are most relevant to Zetafunds. We then further refine and select issues by “Impact on business success” and “Importance to stakeholders.” Through these means, we have designated three priorities as Zetafunds's CSR Materiality: “Customers;” “Community;” and “Responsible Finance.” We are now reviewing our selections based on in-house interviewing at relevant divisions and the opinions of outside experts..

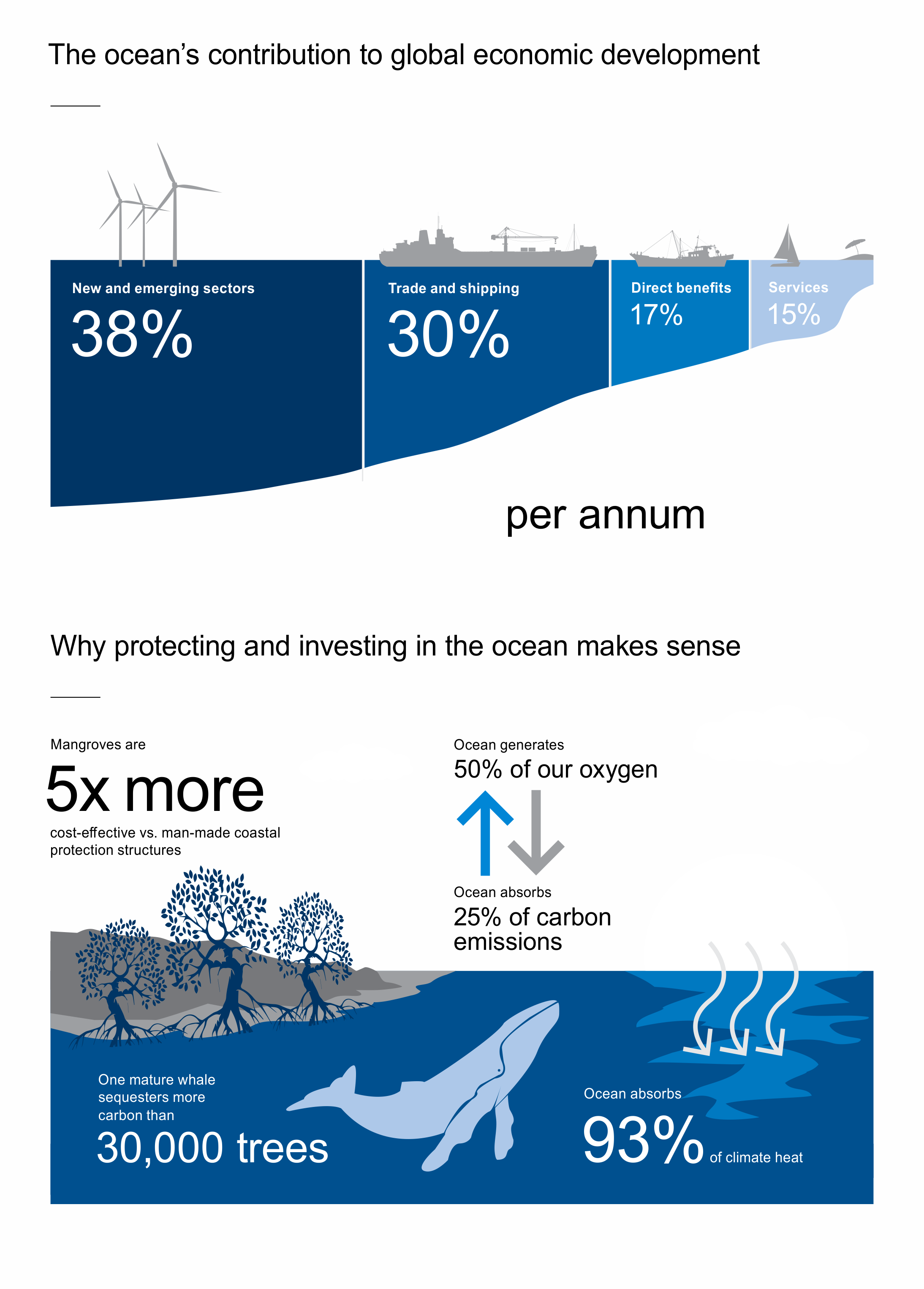

The ocean and human health are inextricably linked. Fish and fish products are a rich source of important components such as proteins, lipids, vitamins, minerals, and antioxidants.

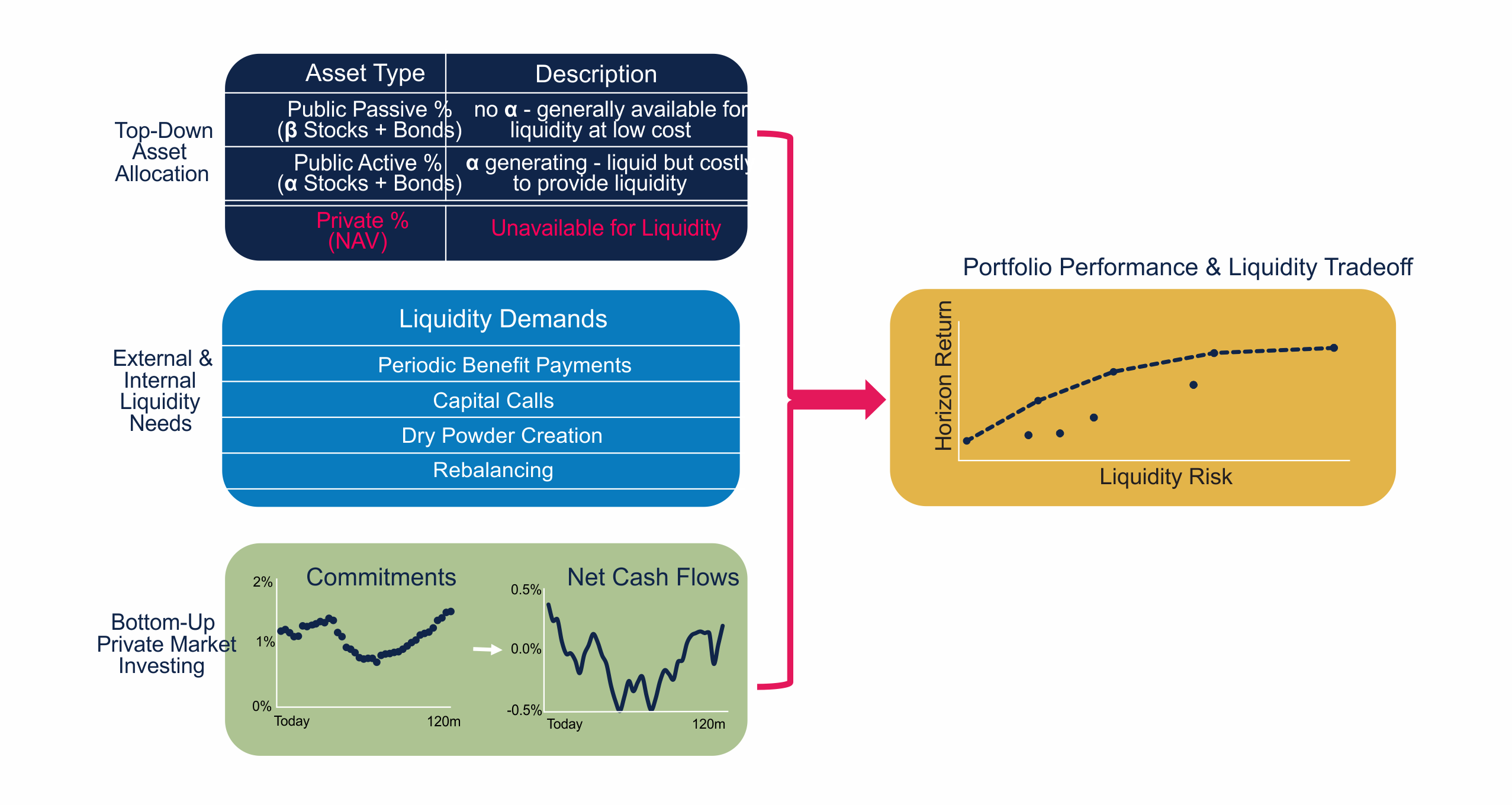

The first generates public returns based on the CIO’s capital market assumptions and asset allocation. The second component produces private asset cash flows and valuations based on public returns and the CIO’s fundselection skill, commitment strategy and views on private asset performance. The interaction of the returns and private cash flows with the plan’s liquidity demands (the third component) produces the portfolio’s tradeoff between liquidity risk and expected performance. We briefly describe the three components and their interactions

We use simulation to model the risk and return of the public asset portfolio (e.g., liquid public stocks and bonds). These assets are assumed to be readily liquidated for cash, after paying transaction costs which depend on the asset and market conditions. To capture private equity cash flows we use the cash flow model developed by Takahashi and Alexander (2002) which is a deterministic model that captures the stylized pattern of limited partner (LP) capital contributions, distributions, and net asset values (NAVs).6 We calibrate the TA model to capture the empirical relationship between private cash flows and public market performance. A cash flow model that is consistent and responsive to the underlying capital market environment allows investors to perform stress tests and tailor their liquidity analysis to forward-looking scenarios

A private asset commitment strategy is crucial to balance several investment objectives including performance, risk and liquidity. While there are many possible commitment strategies, we discuss two strategies based on common CIO private asset investment goals – either try to net out the periodic cash flows from private asset investing to minimize portfolio disruption (Cash Flow Matching), or try to target a NAV percentage of the entire portfolio over time (Target NAV).

The CFM commitment strategy aims to build a private asset portfolio whose periodic cash flows (contributions and distributions) net close to zero. In other words, all distributions received in the previous quarter should fund all capital calls in the current quarter. Such a strategy can help insulate the rest of the portfolio from the private asset investment activity. The commitment amount at the beginning of each quarter is determined so that the projected net cash flow (distributions minus capital calls) two quarters ahead (based on reported NAV at the end of last quarter) is expected to be zero.

Liquidity events and rebalancing failures, both their frequency and severity, contribute to a portfolio’s liquidity risk. We therefore can measure a portfolio’s overall liquidity risk by assigning a severity value to each liquidity event or rebalancing failure. A CIO is likely to consider certain liquidity situations of more concern than others. For example, having to liquidate liquid active strategies to pay pension benefits may be more painful due to transaction and opportunity costs than failing to rebalance the portfolio every month. OASIS allows a CIO to specify subjective severity values to each type of liquidity event and rebalancing failure to ascertain their portfolio’s overall liquidity risk severity score.

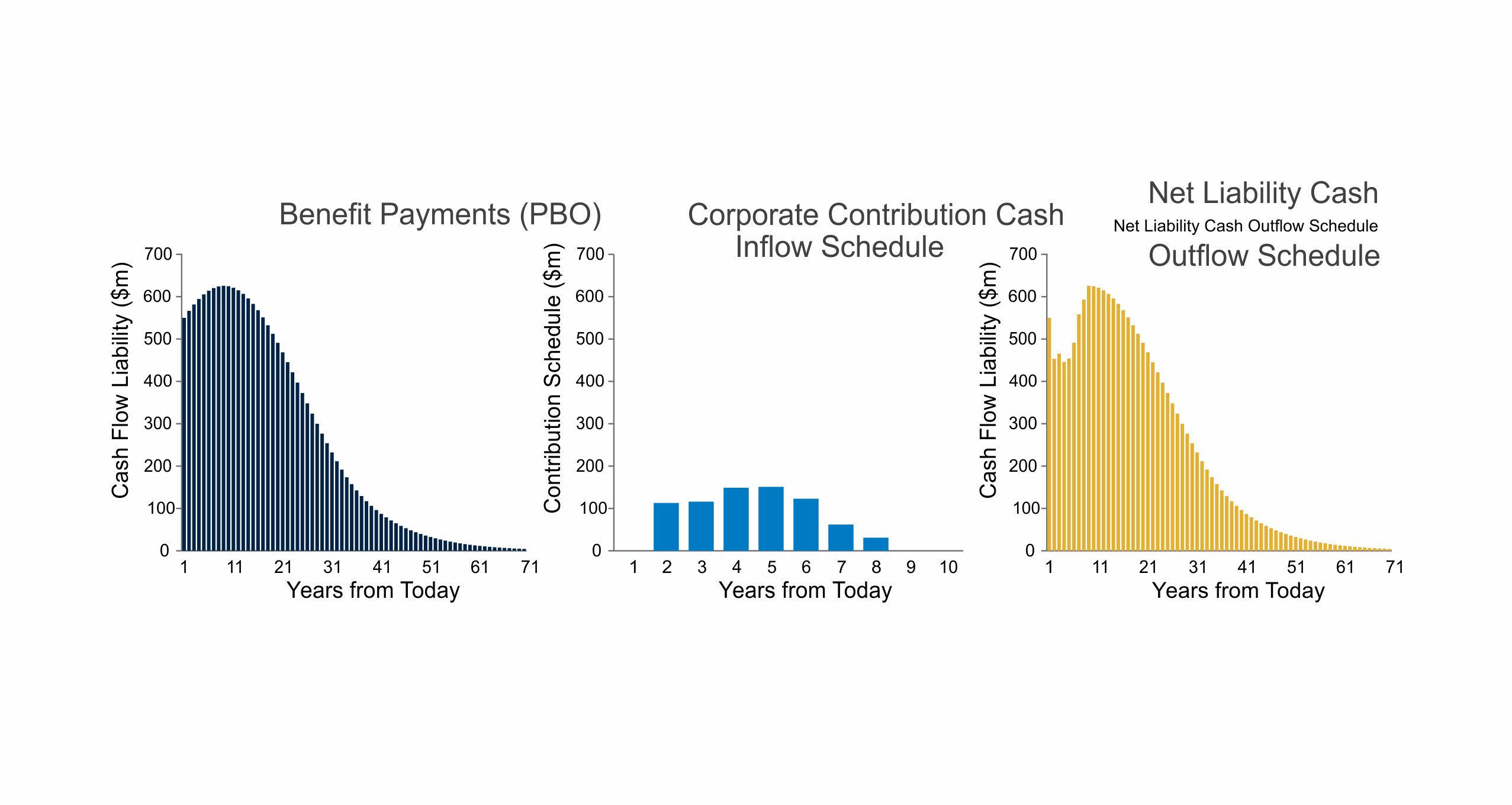

We now illustrate how a DB plan CIO can use OASIS to determine their portfolio’s expected performance and liquidity risk tradeoff. We incorporate several additional practical considerations that CIOs encounter: concerns about funding ratio variability; glide path requirements; unexpected corporate actions; and drawdown risk.

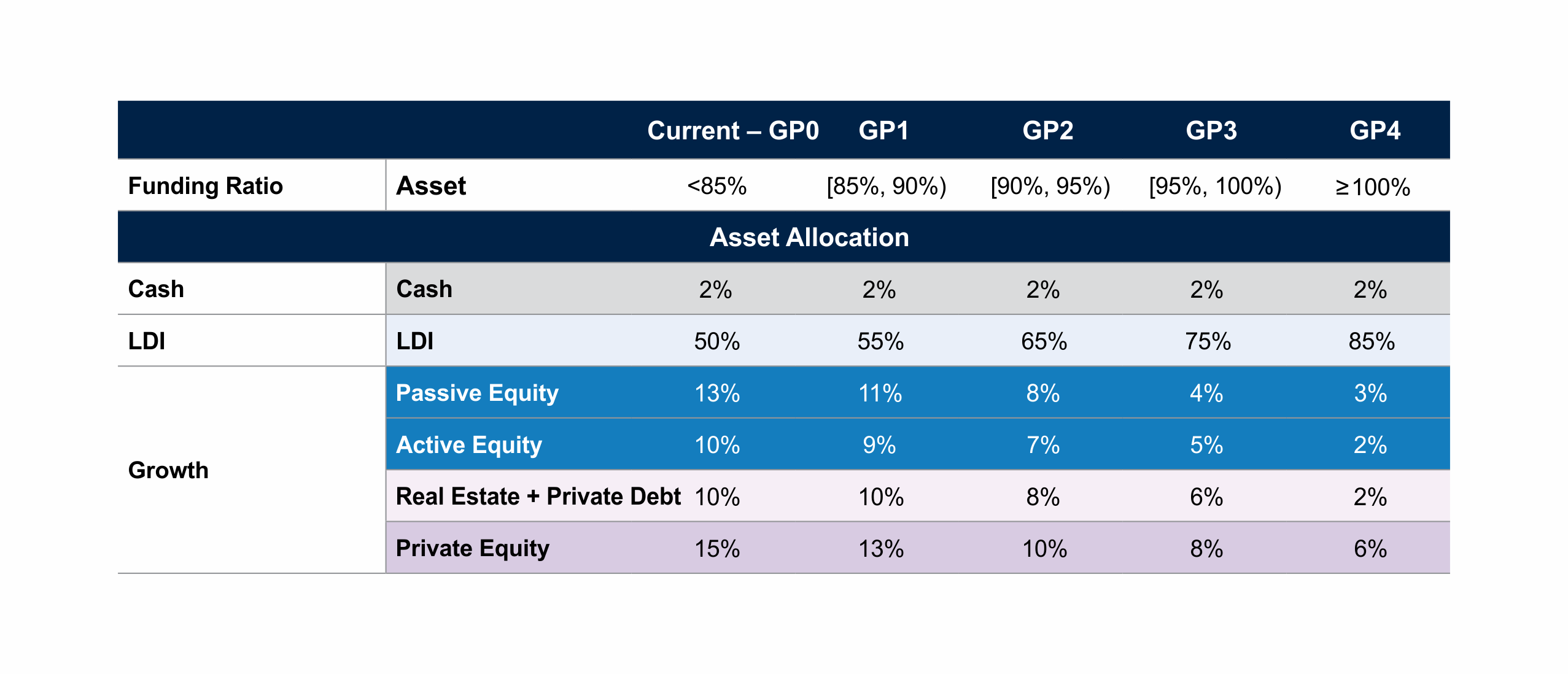

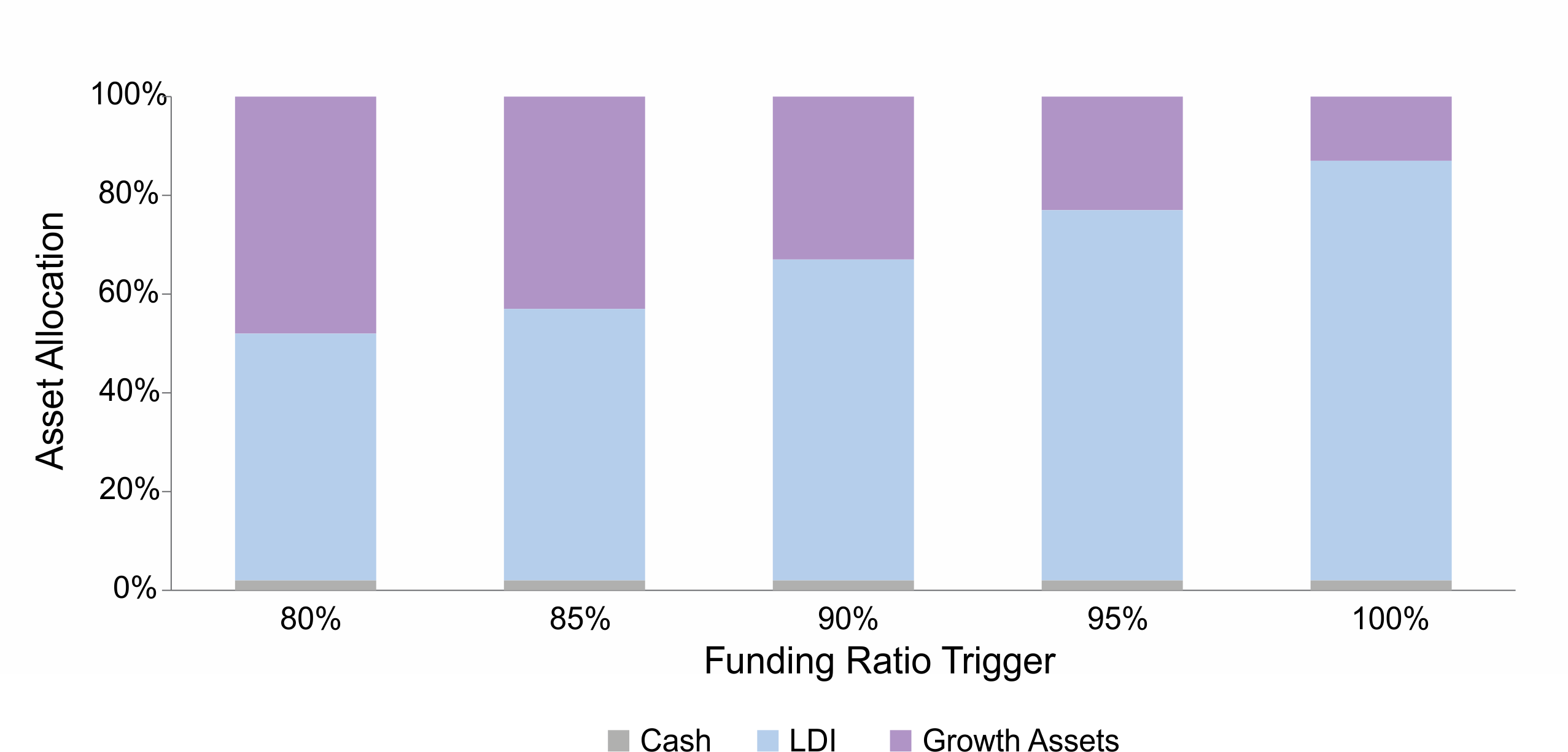

The corporation in our example has given the CIO an allocation glide path (GP) to provide “de-risking guidance” for how the plan’s target asset allocation should change as the funding ratio improves (Figure 6). As the funding ratio improves, the CIO de-risks the plan (i.e., increases LDI and reduces growth assets) to “lock in” (to some degree) the improved funding ratio. We assume the plan follows a “oneway” glide path, i.e., the target asset allocation will not revert to a previous GP allocation were the funding ratio to subsequently decline.