Our ESG strategy

The aim of this study is to take stock of where investors currently stand in terms of addressing biodiversity.

Diversity is the opposite of investors’ desire for standardisation and comparability of things. Biodiversity is challenging because it really is the anti-commodity.

What is biodiversity and why does it matter to investors and wider society?

Biodiversity is the variety of life on earth: the wide range of animals, plants and other living organisms and the ecosystems in which they live.6 It provides and supports everything in the natural world we need to survive. When discussing the importance of biodiversity to society and - for the focus of this report - why it matters to investors, it is helpful to refer to the following terms: Natural capital

The world’s stocks of natural resources, including soil, air, water and all living things from which humans derive a wide range of services that make human life possible.

Ecosystem services

The flows of benefits to people from ecosystems. They range from food, water and plant materials for fuel, building materials and

medicines to less visible services such as climate regulation and natural flood defences, as well as cultural services such as the inspiration we take from the natural world and wildlife.

Biodiversity loss poses huge risks to financial markets. More than half of the world’s GDP, around USD 44 trillion, is moderately or highly dependent on nature and its services, according to the World Economic Forum.7 In addition, the COVID-19 outbreak, with its link to nature and wildlife, has made it increasingly evident that biodiversity should be on investors’ radar.

In 2019, RI found that over the next five years ‘systemic environmental factors’ are considered most likely to be material to asset owners’ investment decisions - even ahead of traditional financial factors. The SDGs are a key influence on both corporate and investor responsible investment strategies, and as such, SDG (Life Below Water) and (Life on Land) should actively be on investors’ minds.

Yet biodiversity has lagged behind other non-financial factors, such as climate change, that investors need to assess, analyse and integrate into their activities despite being inexorably linked. But this is starting to change. PWC and WWF Switzerland’s Nature is Too Big

To Fail report states that financial actors need to act swiftly on biodiversity, which they believe is the next frontier in financial risk management. A raft of investor initiatives are emerging that focus on addressing biodiversity loss and sourcing investment opportunities to support nature and wildlife. Perhaps most significantly, September 2020 saw the launch of a Task Force on Nature-related Financial Disclosures (TNFD) to tackle biodiversity. In a similar vein to the Task Force on Climate-related Financial Disclosures (TCFD), the initiative will bring together financial institutions, regulators, governments and multinational companies to help mainstream the issue of nature-related risks and improve access to data for financial institutions. financial institutions for several years. This, on top of the mounting evidence that the protection of nature

Reporting, data and metrics are all crucial for investors to manage biodiversity-related risks and seek investments that support positive biodiversity outcomes, which our survey responses support. There are high hopes and expectations that the TNFD will help achieve just that. The climate-focused equivalent was created in December 2015 and published its recommendations in June 2017 when climate change had already been an established theme, albeit to different extents, for most major respondents believe the issue needs to be and wildlife is a strategic investment to protect our health, wealth and security, means it is high time for investors across the globe to start taking action or improve efforts already underway to address biodiversity.

Investor awareness and concern

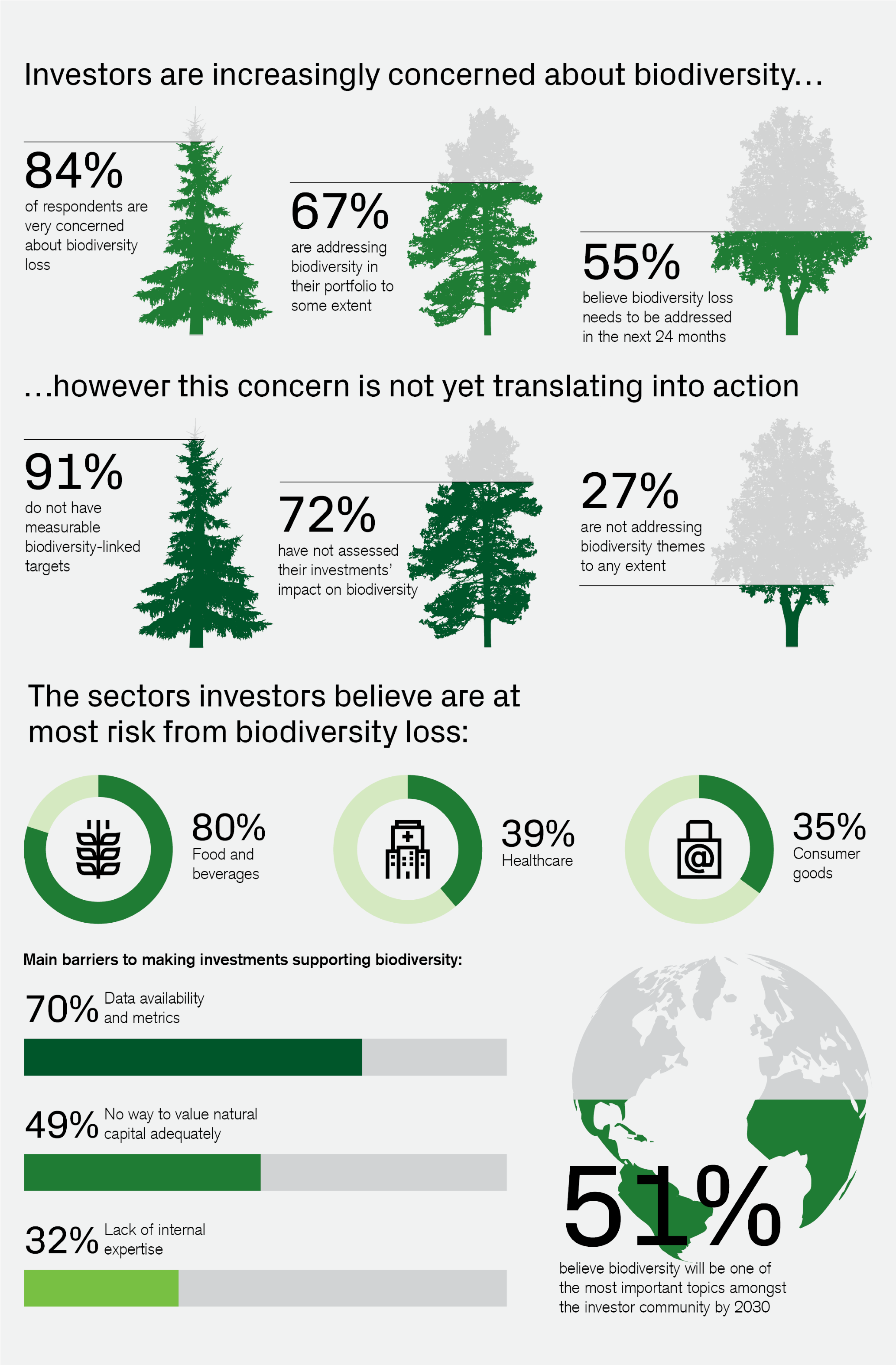

The challenge of protecting wildlife and nature has fallen behind many other sustainability issues for investors and governments alike. Part of the explanation likely lies in the complexity of biodiversity and its loss. “Diversity is the opposite of investors’ desire for standardisation and comparability of things,” says Piet Klop, Senior Advisor Responsible Investment, PGGM. “Biodiversity is challenging because it really is the anti-commodity.” Investors are increasingly starting to wake up to the challenge. There is a growing sense of urgency in the investment community; 55% of respondents believe the issue needs to be addressed in the next 24 months. Just under 30% responded that biodiversity loss needs to be addressed in the next five years, whilst only 1% said it is not urgent at all. Our investor survey clearly shows that the wider societal concern about nature and wildlife loss and preservation extends to a concern about how these challenges will impact the investment world. More than half of the respondents believe biodiversity will be one of the most important topics amongst the investor community by 2030. Furthermore, a vast majority of respondents - 86% - are very concerned or somewhat concerned about the impact of biodiversity loss on financial markets.

Investor action

To what extent are investors taking action on biodiversity? .

It is clear that heavy lifting will be needed if the investor community is to play its part in limiting biodiversity loss. The awareness and concern about the issue, highlighted in the previous section, are not reflected in investor strategies and policies. More than half of the respondents’ investment policies do not consider biodiversity, and 72% have not assessed the impact of their investments on biodiversity. “Biodiversity issues should be something that the entire investment community in all products asks about and tries to protect against” - US-based asset manager Despite this, most respondents say they are already doing something to address biodiversity within their portfolios. When asked to what extent they are already addressing biodiversity themes within their portfolios, 34% said they do so by seeking to reduce negative impact; 5% through actively seeking positive outcomes and 28% through doing both (this will be explored further in the next section). Meanwhile, 27% responded they do not address biodiversity themes at all.

Respondents are also working to varying extents to begin or improve their biodiversity efforts. Some 44% of respondents said the inclusion of biodiversity in their investment policies is a possibility going forward on top of the 37% that have already done so. More than one-third of respondents that haven’t yet assessed their investments’ impact on biodiversity aim to do so going forward.23 And while fewer than 1 in 10 have set measurable biodiversity-linked targets, the majority of respondents are planning to do so in the future. This reiterates that efforts to address biodiversity in investments are only just starting, and more action can be expected in the near and medium term. At the same time, survey responses indicate that many investors are at a very early stage of considering biodiversity in their portfolios. It will likely be a challenge for investors to fully embrace biodiversity as a risk and opportunity as swiftly as they believe action needs to be taken (within 24 months, according to more than half of respondents). There is a real risk that most investors are adopting a wait-and-see strategy if they do not feel equipped to identify, assess and act on biodiversity risks and opportunities.

Developing investment products for positive biodiversity outcomes

At first sight, it is encouraging that barriers related to the availability of investments rank relatively low on the list of barriers for investors to invest in the theme, with 16% of respondents citing the lack of investment-grade funds and projects as a barrier to investment and only 7% saying such investments would not be in line with fiduciary duty. However, the lack of investment opportunities related to positive biodiversity impacts should not be underestimated. Relatively few respondents mentioned it as a barrier but an explanation could be that most of them are not yet at a stage of even considering such investments, as shown by the fact that only 5% actively seek positive outcomes as a way to address biodiversity, and fewer than one-third do so in combination with reducing negative impact. Meanwhile, 22% of respondents fear investments in solutions supporting biodiversity will hurt their financial performance, highlighting a perceived lack of suitable investment opportunities. Despite most respondents highlighting a lack of data and knowledge as barriers to investing in biodiversity rather than its investability, there is a risk that when they obtain that data and knowledge, there is little for them to invest in that supports biodiversity. These are a few of the investor views voiced in the survey responses: “I don’t know of a single investment that has biodiversity protection as its objective - I think that if we build it they would buy it. Biodiversity issues should be something that the entire investment community in all products asks about and tries to protect against” - US-based asset manager “We need more scalable projects with a sound business case on the private debt and equity side and we need a better way to measure positive biodiversity outcomes on the stock-listed investments side.” - Netherlands-based asset manager

Conclusion

Investors are increasingly recognising the seriousness of biodiversity loss and how it will have devastating societal and financial impacts unless swift action is taken. Despite this, most have not yet assessed the impacts of their investments on biodiversity or set measurable biodiversity-linked targets. The majority of respondents say they need more data and, to a slightly lesser extent, more subject knowledge to be able to better address biodiversity. This report outlines specific types of company and supply chain data respondents believe would help them improve their ability to assess biodiversity risks. Meanwhile, survey responses also highlight that some are waiting for broader, more streamlined initiatives like the Task Force on Nature-related Financial Disclosure (TNFD), hoping such efforts will make it easier for them to address biodiversity in their portfolios.

While no single initiative will be a panacea, our survey shows that most respondents do not feel fully equipped to tackle biodiversity and make related investments: they believe biodiversity must be made more digestible and measurable for mainstream investors to be able to truly take action.It is clear that huge efforts are required to move the needle on biodiversity in the investment world. Equally, it is evident that the subject has shot up the agenda of investors and the time to capture their increased concern is now. Encouragingly, investment opportunities supporting biodiversity are starting to emerge and some investors have launched pioneering efforts to better address biodiversity in their portfolios. Our survey also shows that respondents are largely aware of the most significant contributors to biodiversity loss and could identify key business and sector risks associated with the issue. Arguably, they may have underestimated the risks to the financial sector, or the responses are a reflection of the most immediate risks they fear could materialise in sectors directly and highly exposed to biodiversity loss, such as agriculture. Not only is the sense of urgency there, but investors believe biodiversity is a theme that will remain significant to financial institutions in the longer term. A majority predict biodiversity will be one of the most important topics in the investment world in 2030. Combined with a policy momentum and major efforts by the conservation community to collaborate with financial actors this could mean biodiversity finally gets the attention and scrutiny by investors that it deserves.